Discover the Top 10 Prepaid Debit Cards Ideal for Teens

As the world evolves at an unprecedented pace, it becomes increasingly challenging to keep up. Today’s kids are growing up in a vastly different environment from their predecessors, where they are expected to shoulder greater responsibilities. In this context, astute parents understand that imparting financial wisdom is an essential aspect of helping their children navigate the world around them. Fortunately, financial institutions are also stepping up to the plate by offering debit cards that serve as valuable tools for parents to teach their teenagers about money management, budgeting, and smart shopping. But with so many options available, it can be challenging to determine which cards are the best fit for your teen’s needs.

What to look for in debit cards for teens?

When it comes to choosing a debit card for your teenager, it’s essential to compare different options to find the best rates for services. Safety and security should be your top priority, followed by ease of use and affordability. It’s important to avoid adult-oriented cards and instead opt for cards designed specifically for teenagers. These cards are marketed to parents who want to give their kids a head start in learning valuable life skills. While there are many options to choose from, we’ve narrowed down the list to the top ten debit cards that provide the safest and most comprehensive services and safeguards for teenagers.

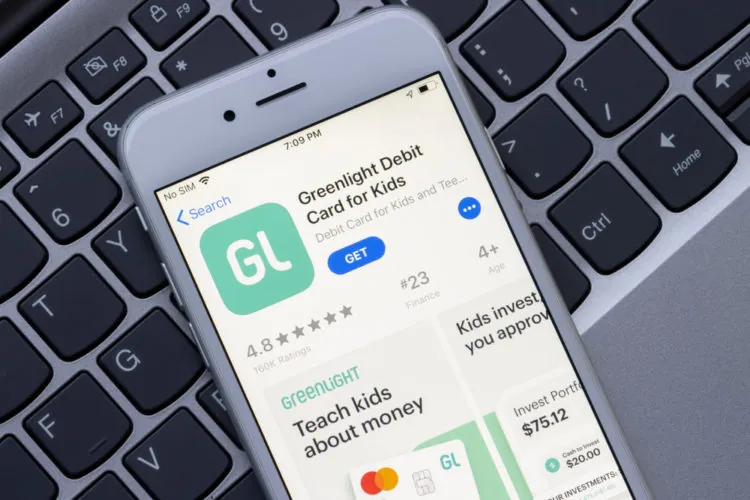

10. Greenlight Debit Card

The Greenlight Debit Card serves as a valuable educational tool for both parents and kids. As the parent, you have complete control over all settings and can receive real-time notifications for every purchase made by your teen. Additionally, the card allows for instant money transfers, making it easy to send funds directly to your teen’s account. You’ll also receive alerts in the event that the card is used or declined. With the Greenlight Debit Card, you have the ability to set limits on where your young shoppers can use the card and how much they’re permitted to withdraw from ATMs.

With the Greenlight debit card, you are in control of your spending limits. This card enables you to keep a close eye on your balances and easily view your account activity history. Plus, it offers the convenience of mobile payments through Apple Pay or Google Pay.

With this option, you will get a MasterCard that is equipped with personalized Zero liability protection. By using the app, you can conveniently turn the card on and off. Additionally, unsafe spending categories are automatically blocked for your safety. This card is also FDIC insured for up to $250,000, providing you with peace of mind. If you ever encounter any issues, there is always 24/7 customer support available to assist you. Furthermore, an extra safety feature is in place to protect your funds in the event of a lost or stolen card. You can log in with touch or face ID to prevent any potential theft.

9. GoHenry

If you want to teach your kids how to manage their finances, then GoHenry is the perfect solution for you. It is a debit card specifically designed for children between the ages of six and eighteen. The card is customizable, allowing you to choose from a range of colors, patterns, and pictures. The best part is that it comes with interactive games that focus on money management missions, where players can earn virtual badges. With GoHenry, parents can set limits on how, when, and where the card is used through parental controls, making it an excellent tool to teach your kids financial responsibility.

The accompanying mobile app ensures that parents have access to the spending history of the card, which can be used at ATMs, in stores, or for online purchases. You can take advantage of a 30-day free trial for both recurring and one-time use. One of the best things about this card is that it is free from the risk of overdraft fees. Additionally, the card empowers kids and teens to create savings goals and set weekly spending limits. However, it’s important to note that the card can only be loaded three times per day, with a limit of $500 per day across all accounts registered to the parents.

8. The Copper Debit Card for Teens

Families can take advantage of the Copper Debit Card with no cost at all for both parents and teenagers. Parents have full control over monitoring the card usage, and it also serves as a great tool for teaching kids how to budget and manage their finances. The card is risk-free from overdraft fees, and there are no minimum balance requirements or monthly charges. Additionally, the card can be used at Allpoint and Moneypass ATMs to withdraw money without any additional fees.

When you get the Copper app, you’ll also receive a card that provides a range of features to help kids learn about money management. The app includes financial quizzes and resources that can teach children about savings and spending habits. Additionally, kids can earn extra money by completing quizzes, and they can set up integrated savings accounts to save for long-term goals. It’s worth noting that some businesses may charge a fee, and these fees can be as high as $4.95. To avoid any surprises, it’s important to check for any fees before making a purchase. Despite this potential downside, the Copper app and card are still considered one of the best options for kids looking to learn about financial responsibility.

7. The BusyKid Debit Card

If you’re looking for a prepaid Visa debit card that can help your kids learn about finances in more advanced ways, the BusyKid Debit Card might be just what you need. With this card, teenagers can invest in real stocks for as little as $10 per investment. This investment card comes with a flat monthly cost of $3.99.

BusyKid offers a convenient feature that enables kids to receive automated allowance loads and assign chores. However, parents are unable to restrict which retailers their children can use. Additionally, ATM fees charged by the BusyKid provider are $1.50, in addition to any fees imposed by the ATM itself.

6. The FamZoo Debit Card

If you’re looking for a debit card for your kids, FamZoo is definitely worth considering. This card comes with a handy app that enables parents to pay allowances on a weekly basis or pay their kids for completing a set of chores. Additionally, parents can track their child’s expenses and purchases, which is a great way to keep tabs on their spending habits. FamZoo also offers the option to purchase mock stocks, an excellent way to teach your child about investing.

With the Famzoo app, your teenager can now request real-time funding from you, allowing them to get instant access to extra cash. The app helps them develop strong money management habits by dividing their account into three buckets for giving, spending, and saving. For a cost of $5.99 per month, your teen can have the Famzoo debit card, and you can even try it out for free for 30 days.

5. Brinks Prepaid Mastercard

The Republic Bank & Trust Company offers the Brinks Mastercard, a prepaid card that comes with a range of benefits. With this debit card, users receive instant text and email notifications whenever a payment or purchase is made. The card is widely accepted, just like any other Mastercard debit card. One of the best things about this card is that there is no need for a credit check, and there is no risk of incurring overdraft fees. Additionally, the card can be personalized by adding your teen’s name as an authorized user on your account.

4. PayPal Prepaid Mastercard

Your teenager can now earn cashback and enjoy customized offers by using the PayPal Prepaid Mastercard. This card, which is offered through Bankcorp, enables instant transfer of funds from your PayPal account to the prepaid card.

As a parent, you have the ability to keep track of your older teens’ spending history by monitoring the usage of their debit card. The best part is that no credit is needed, as it is a debit card. PayPal, a prominent payment services provider, offers easy access to the account via a mobile app or the internet.

3. NetSpend Prepaid Visa Card

MetaBank is the issuer of Netspend and it is covered by FDIC insurance. The card is universally accepted wherever Visa is accepted. One of the best features of this card is that it does not charge any late fees, interest charges, or overdraft fees. With the NetSpend Mobile app, your teenager can effectively manage their finances. You will receive email alerts and text messages to keep track of your teen’s spending and purchases. This debit card is secure and reliable, and the monthly fees are based on the account balance.

2. Serve American Express Prepaid Debit Account

Teens in their later years will find it beneficial to gain knowledge on managing American Express debit cards through the use of Serve debit cards. With this card, they can keep track of their account balance and view their recent transactions, all while learning how to manage their finances, make purchases, and budget their money. Additionally, preloading set amounts onto the card is a simple process that can be done by parents.

With this card, your teen can enjoy free cash withdrawals at MoneyPass ATMs. However, they may incur fees for withdrawing cash from other ATMs. The best part is that there are no hidden fees and no credit checks required. By setting up direct deposits of $500 or more per statement period from their job, your teen can avoid monthly charges for the account. This practice can help them learn responsible financial habits early on.

With the help of its mobile application, the card serves as a comprehensive savings account that is specifically designed for teenagers. It assists them in setting and achieving their financial goals, both in terms of spending and saving. Additionally, for a nominal fee, the card can be reloaded to add more funds to the account.

1. Mango Prepaid Mastercard

If you’re looking for a debit card that can help your teen develop their financial literacy skills while still allowing them to enjoy the perks of having their own spending limit, the Mango card is an excellent choice. Not only does it offer a competitive interest yield through its Mango Savings Account, but it also comes with a user-friendly mobile application that links the card and savings account. This allows your teen to send and receive money with ease, while funds are loaded instantly onto the card without any activation, monthly, or annual fees. Overall, the Mango card is a fantastic way to introduce your teen to responsible spending habits.

Read More: