Unbelievable! The Shocking Truth About Payday Loans in Texas!

In the Lone Star State, payday loans have become a quicksand for many unsuspecting borrowers, trapping them in a cycle of debt that’s hard to escape. These short-term loans, often seen as a lifeline in times of financial crisis, come with exorbitant fees and interest rates that make them a perilous choice for those already struggling financially. The shocking truth about payday loans in Texas reveals a deeply troubling reality that affects countless individuals and families.

Payday Loan Fees in Texas: A Shocking Burden

One of the most startling aspects of payday loans in Texas is the astronomical fees and interest rates associated with them. The average annual percentage rate (APR) on a payday loan in the state stands at a staggering 664%. To put this into perspective, if you were to borrow $500, you would end up paying $3,320 in interest over the course of a year. This is a heavy financial burden for anyone, especially for those already grappling with financial instability.

The Vicious Cycle of Payday Loan Debt

Due to the structure of payday loans, they often lead to a vicious cycle of debt. These loans are typically due on the borrower’s next payday, which can be as soon as two weeks after taking out the loan. Many borrowers find it impossible to repay the full loan amount and interest in such a short period. As a result, they may choose to roll over the loan into a new one, incurring additional fees and interest charges. This perpetuates a cycle where borrowers are continually paying off interest and fees without making a dent in the principal balance.

Predatory Lending Practices

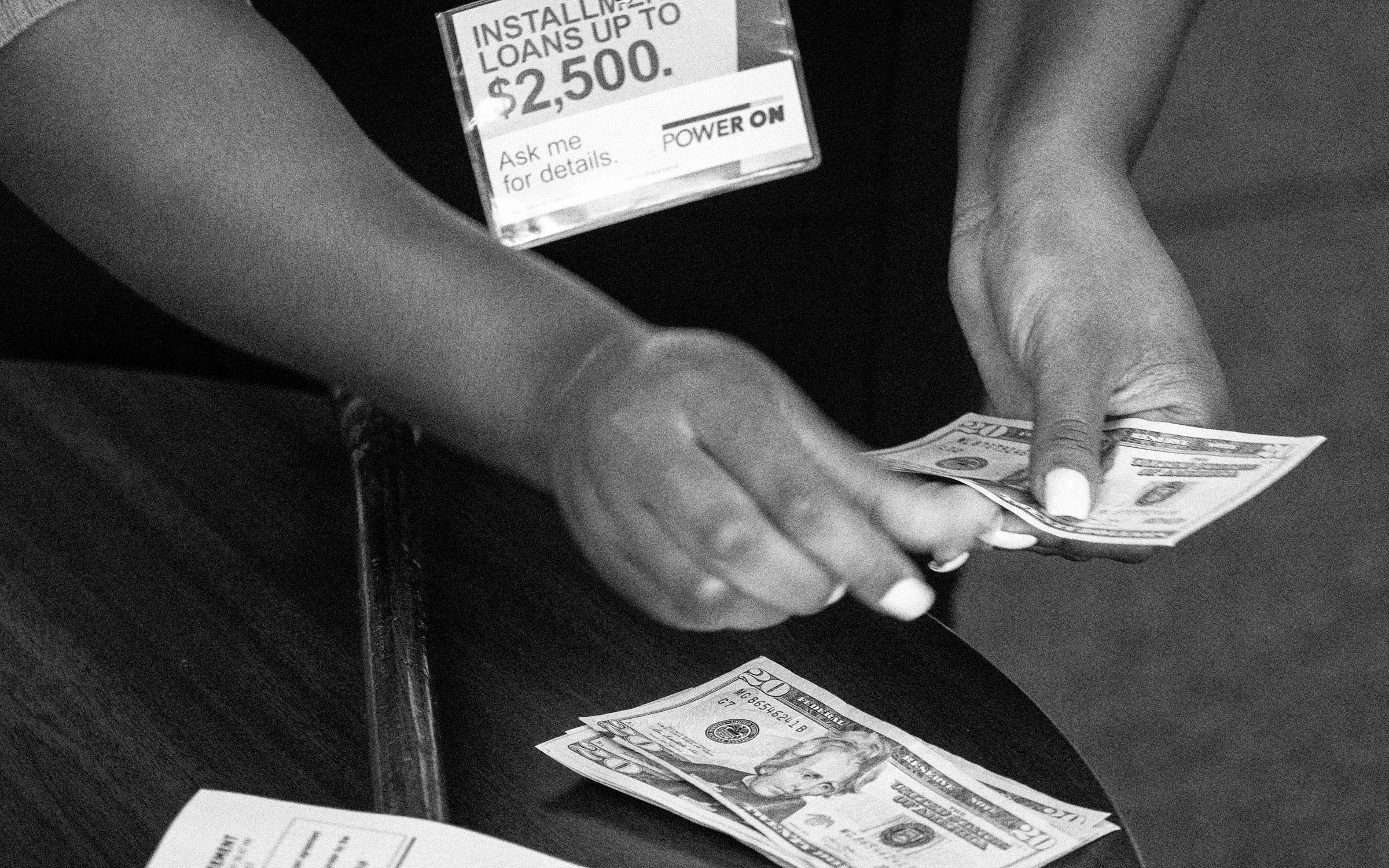

Payday lenders in Texas often engage in predatory lending practices. They frequently target low-income individuals and communities of color who are more vulnerable to financial instability. To lure borrowers in, they may use deceptive marketing tactics, portraying payday loans as “easy money” or promoting “no credit check required.” The reality, however, is far from these enticing claims. Borrowers often find themselves ensnared in a web of debt, facing mounting interest charges that are difficult to escape.

Disproportionate Impact on Vulnerable Communities

The impact of payday loans falls disproportionately on low-income borrowers and communities of color. According to a 2021 report by the Consumer Financial Protection Bureau, a significant 80% of payday loans are taken out by repeat borrowers. This suggests that many individuals are resorting to payday loans to cover basic expenses such as rent, food, and utilities.

Studies have also revealed that African Americans are more likely to use payday loans than any other racial or ethnic group. A 2017 study by the Pew Charitable Trusts found that these loans disproportionately affect this community. This indicates that payday loans are not only financially predatory but also contribute to systemic racial disparities.

Impact on Credit Scores

Another shocking truth about payday loans in Texas is their detrimental impact on borrowers’ credit scores. When borrowers default on payday loans, lenders have the authority to report these defaults to credit bureaus. This can significantly diminish borrowers’ creditworthiness, making it challenging to obtain other types of loans, including mortgages and car loans. The consequences of payday loans linger long after the debt is repaid.

What Can Be Done to Address the Crisis?

Addressing the payday loan crisis in Texas requires a multi-pronged approach. First, policymakers should consider capping the exorbitant interest rates and fees that payday lenders can charge. Implementing stricter regulations can provide much-needed relief to borrowers.

Alternatively, some advocates propose banning payday loans altogether, as several states have done, to prevent the continued exploitation of vulnerable individuals. Such measures, combined with comprehensive financial education, could go a long way in eradicating the problem.

For consumers, self-protection begins with education. Understanding the risks associated with payday loans is vital. Developing a budget and establishing an emergency fund can help individuals avoid unexpected expenses that might lead to considering payday loans. An emergency fund acts as a safety net, reducing the reliance on these high-cost loans.

If you are already mired in payday loan debt, don’t despair. Resources are available to help you navigate this challenging situation. Reach out to a credit counselor or a debt relief agency to explore options for managing and ultimately eliminating your payday loan debt.

Furthermore, there are specific measures that can be taken to protect consumers and promote responsible lending practices:

- Income Verification: Require payday lenders to verify borrowers’ income and ability to repay the loan, preventing individuals from taking out loans they cannot afford.

- Ban Loan Rollovers: Prohibit payday lenders from rolling over loans, helping to break the cycle of debt.

- Database of Borrowers: Establish a database of payday loan borrowers to identify those at risk of default and provide support, such as financial counseling and debt management programs.

- Promote Access to Affordable Alternatives: Encourage access to affordable credit alternatives, such as credit unions and community development financial institutions (CDFIs), to provide safer borrowing options for consumers.

By implementing these measures, we can work toward a fairer financial landscape for all Texans and protect consumers from the predatory lending practices of payday loan establishments.

In Conclusion,

The shocking truth about payday loans in Texas is a stark reminder of the urgent need for change. High fees, predatory lending practices, and disproportionate impacts on vulnerable communities have created a cycle of debt that is difficult to break. Advocates, policymakers, and individuals alike must collaborate to find solutions that protect borrowers from the financial trap of payday loans and promote fair and responsible lending practices. By taking these actions, we can work toward a more equitable and just financial system for all.