Unbelievable! The Shocking Truth About Payday Loans in Georgia!

Payday loans are a type of short-term loan that is designed to help people with unexpected expenses. However, payday loans can be very expensive and can lead to a cycle of debt. In Georgia, the payday loan industry is particularly predatory, with some lenders charging interest rates as high as 400%. This article will explore the shocking truth about payday loans in Georgia and how they are trapping borrowers in a cycle of debt.

The Predatory Nature of Payday Loans in Georgia

Payday loans are designed to be quick and easy to get. However, this convenience comes at a high price. In Georgia, payday lenders are allowed to charge interest rates as high as 400%. This means that a borrower who takes out a $500 payday loan could end up paying over $2,000 in interest and fees.

In addition to high interest rates, payday lenders in Georgia often use unfair and deceptive practices. For example, they may not disclose all of the fees associated with the loan, or they may pressure borrowers into taking out additional loans.

The Impact of Payday Loans on Georgia Borrowers

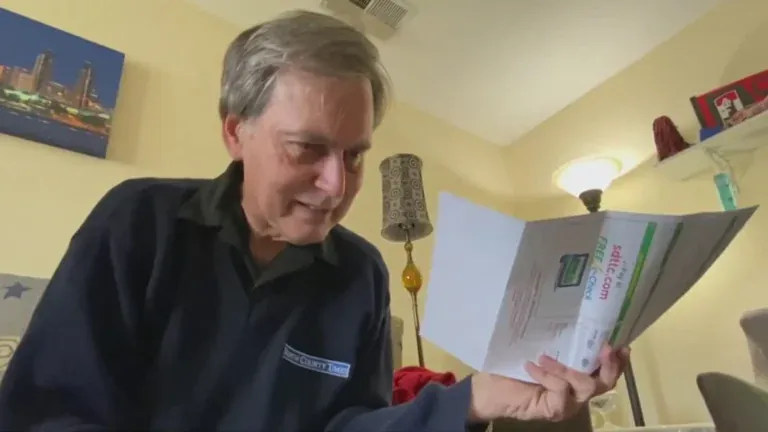

Payday loans can have a devastating impact on Georgia borrowers. The high interest rates and fees can quickly lead to a cycle of debt that is difficult to escape. Borrowers may have to take out additional loans to pay off their existing loans, and they may end up living paycheck to paycheck.

In addition to the financial burden, payday loans can also cause emotional distress. Borrowers may feel overwhelmed by debt and may experience anxiety, depression, and even suicidal thoughts.

What Can Be Done to Protect Georgia Borrowers from Payday Loans

There are a number of things that can be done to protect Georgia borrowers from payday loans:

-

Strengthening state laws: The Georgia legislature could pass laws that would cap interest rates on payday loans, prohibit unfair and deceptive practices, and require lenders to provide more transparency to borrowers.

-

Increasing financial education: Borrowers need to be aware of the risks of payday loans before they take out one. Financial education programs can teach borrowers about the predatory nature of payday loans and help them to make informed financial decisions.

-

Expanding access to affordable alternatives: Borrowers who need quick access to cash should have access to affordable alternatives to payday loans. This could include credit unions, community development financial institutions (CDFIs), and online lenders.

Conclusion

Payday loans are a predatory trap that is ensnaring Georgia borrowers in a cycle of debt. The high interest rates and fees can quickly lead to financial hardship and emotional distress. It is important to take action to protect Georgia borrowers from payday loans.

Read More:

- Unbelievable! The Shocking Truth About Payday Loans In Iowa!

- Unbelievable! The Shocking Truth About Payday Loans In New Jersey!

FAQ’s

Q. What are the interest rates on payday loans in Georgia?

The interest rates on payday loans in Georgia can be very high. The maximum interest rate allowed by law is 400%. This means that a borrower who takes out a $500 payday loan could end up paying over $2,000 in interest and fees.

Q. What are the fees associated with payday loans in Georgia?

In addition to interest, payday lenders in Georgia can charge a number of fees. These fees can include application fees, origination fees, and maintenance fees. The total fees associated with a payday loan can be as high as 30% of the loan amount.

Q. What are the risks of taking out a payday loan?

There are a number of risks associated with taking out a payday loan. These risks include:

- High interest rates and fees: Payday loans can be very expensive, and the high interest rates and fees can quickly lead to a cycle of debt.

- Unfair and deceptive practices: Payday lenders in Georgia often use unfair and deceptive practices, such as not disclosing all of the fees associated with the loan or pressuring borrowers into taking out additional loans.

- Financial hardship: Payday loans can lead to financial hardship, such as eviction, bankruptcy, and repossession.

- Emotional distress: Payday loans can cause emotional distress, such as anxiety, depression, and even suicidal thoughts.

Q. What should I do if I am struggling with payday loan debt?

If you are struggling with payday loan debt, there are a number of things you can do to get help. These include:

- Contacting a credit counselor: A credit counselor can help you to create a budget and develop a plan to repay your payday loan debt.

- Talking to your lender: You may be able to negotiate a lower interest rate or payment plan with your lender.

- Filing a complaint with the Consumer Financial Protection Bureau (CFPB): The CFPB is a government agency that protects consumers from unfair and deceptive practices. You can file a complaint with the CFPB if you believe that you have been treated unfairly by a payday lender.

Q. How can I prevent myself from taking out a payday loan?

There are a number of things you can do to prevent yourself from taking out a payday loan. These include:

- Creating a budget: A budget can help you to track your income and expenses and avoid unexpected expenses that may lead you to take out a payday loan.

- Building an emergency fund: An emergency fund can help you to cover unexpected expenses without having to take out a payday loan.

- Seeking help from a financial advisor: A financial advisor can help you to develop a plan to reach your financial goals and avoid payday loans.